SMSF Lending

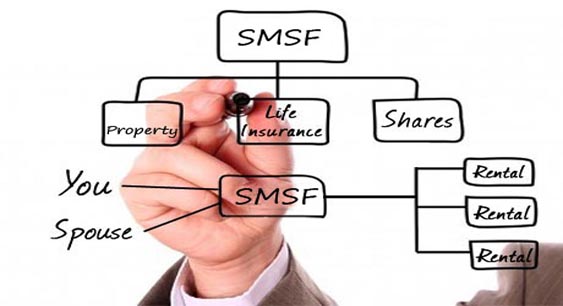

Self Managed Super Funds (SMSF) have increased in popularity over recent years. They are a great way to save for your retirement or to get into the property market. A Self Managed Super Fund (SMSF) is a superannuation trust structure that provides financial remuneration to its members at retirement. The main difference between SMSF’s and other super funds is that SMSF members are also the trustees of the fund. They can have between one and four members. They have their own Tax file number (TFN) and Australian Business Number (ABN) and a transactional bank account which allows them to receive super contributions and rollovers, make investments and also pay out pensions.

If you would like to invest in property, but don’t have enough funds to make an outright purchase, you may be able to borrow money through your Self Managed Super Fund and receive many of the same benefits as traditional property investors, however, borrowing or gearing your super into property must be done under very strict borrowing conditions which is called a "Limited Recourse Borrowing Arrangement" (LRBA). The LRBA rules are quite complex and involved so it is best to speak with a Financial Adviser or an Accountant first to find out this option is right for you.

Some things you need to consider:

- What are the pros and cons of starting a SMSF?

- What’s involved in purchasing property with my SMSF?

- What are the upfront and ongoing costs involved in setting up an SMSF?

- What are the compliance requirements of being a super trustee?

- How can I ensure that I have an overall successful investment strategy within my SMSF?

Contact Us

If you have any questions call us on (02) 8004-8699 or Email Us to set up an appointment.